———– Lease Copiers | Best Price on Every Brand and Model ———–

Leasing copiers and printers has emerged as an appealing option for businesses seeking to manage their printing requirements without incurring significant upfront costs associated with purchasing equipment. This article provides an overview of leased copiers and printer rentals, detailing their operational mechanisms and the advantages they present, including reduced initial expenditures and access to the latest technology. It is equally important to consider potential drawbacks and to understand the criteria for selecting the appropriate copier or printer for specific needs. Whether one represents a small business or a large corporation, this guide by Commercial Copy Machine is designed to facilitate an effective navigation of the leasing process.

COMPARE QUOTES – CLICK BELOW

What Are Lease Copiers?

Lease copiers represent specialized office technology solutions that enable businesses to utilize high-capacity printers and copiers through flexible rental agreements, rather than through outright ownership of the equipment.

This option is particularly advantageous for organizations that require document management during peak periods, such as legal war rooms, event coordination environments, and conferences where timely support and on-site assistance are critical.

Companies such as We Rent Copiers, USA Copier Lease, and Xerox provide a range of leasing benefits that accommodate various budgetary requirements and upgrade options, offering customized solutions to address the distinct needs of each business.

How Do Lease Copiers Work?

Lease copiers operate through a structured rental agreement with a leasing company, enabling businesses to utilize office technology without the financial burden of outright purchases. This approach can alleviate cash flow constraints and simplify budget management. Furthermore, leasing provides flexibility and adaptability, allowing companies to respond effectively to changing demands and technological advancements without the financial strain associated with acquiring expensive equipment.

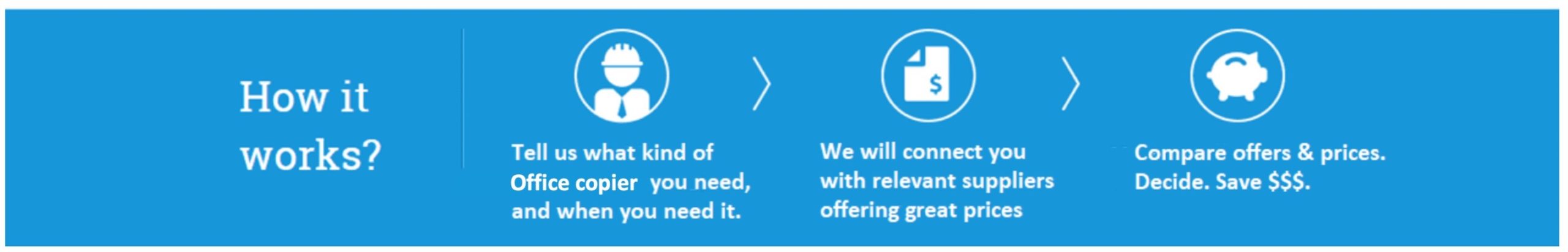

When navigating the copier leasing process, it is essential to adopt a systematic approach for easy rentals:

- Choose a rental company: Conduct thorough research on various leasing companies, taking into account their reputation, customer service, support offerings, and delivery setup.

- Evaluate lease terms: Carefully review the lease agreement, paying close attention to the lease duration, payment terms, and options for renewal or termination.

- Explore equipment options: Identify the specific copier models and features that align with your business requirements, such as print speed, color capabilities, maintenance plans, and print security.

By understanding these steps, businesses can capitalize on the advantages of leasing, which can enhance operational efficiency while ensuring that rental agreements align with financial constraints. Leasing commercial copiers can provide the flexibility and adaptability needed to thrive.

How Much Does it Cost to Lease a Copier?

Leasing a copier is a practical solution for businesses that need high-quality printing capabilities but want to avoid the high upfront costs of purchasing equipment outright. The cost of leasing a copier can vary widely based on several factors, including the type of copier, its features, the lease term, and the vendor. The below represents the national average cost to lease office copiers.

| Office Copier Type | Features | Avg. Monthly Lease Cost |

| Standard Office Copy Machine | B&W or Color Print | $125–$3750 |

| Multifunctional Copiers | Copy/Print/Scan/Fax + Color | $500–$5,000 |

| High Speed Commercial Copiers | 60+ PPM, Color + All Options | $900–$24,500 |

Canon Copier MF7470

-25 PPM

-600×600 DPI

–GET QUOTE

-Ethernet Port

Xerox COLORQUBE 9303

-Multifunction

-Color, Solid Ink, Email

–GET QUOTE

-Total Security

WorkCentre 7855 PTXF2

-55 PPM

-100 Sheet Bypass Tray

–GET QUOTE

-Color/Mono w/Hicap

HP Laserjet Enterprise 700 M775f

-Color

-800 MHz Processor Speed

—GET QUOTE

-600 x 600 DPI

Lexmark 4 Laser X680DE

-Monochrome Laser

-1200×1200 DPI

–GET QUOTE

-80 GB Hard Disk Drive

Sharp Multifunction MX-2615N

-26 PPM

-Duplex

–GET QUOTE

-999 Continuous Copies

WorkCentre 7830 W/4X520

-Data Security

-30 PPM

–GET QUOTE

-Ifax

Lexmark Copier Mx810de

-Copy, Fax, Print, Scan

-Touch Screen

–GET QUOTE

-55 PPM

Oki Laser Copy Machine MB790m

-Copy, Fax, Print, Scan

-Duplex Document Feeder

–GET QUOTE

-1200 x 1200 DPI

What Are The Benefits Of Leasing Copiers?

Leasing copiers presents numerous advantages that can substantially enhance a business’s operational efficiency and financial planning.

One of the key benefits is the reduction of initial costs, as organizations can circumvent significant capital expenditures at the outset and instead choose predictable monthly payments that align more effectively with their cash flow.

Furthermore, leasing facilitates access to the latest technology, allowing businesses to utilize high-capacity printers and advanced copiers without the burden of frequent upgrades. Additionally, certain leasing arrangements may offer tax benefits, further contributing to the overall financial advantages of this approach.

Lower Initial Costs

One of the key advantages of leasing copiers is the reduced initial costs associated with acquiring office technology, which enables businesses to allocate their capital toward other essential functions. Moreover, leasing copiers and printers from trusted providers ensures high-quality support.

By choosing leasing over purchasing, companies can significantly lower upfront expenditures, rendering it a more financially advantageous option in numerous scenarios. This approach allows them to redirect funds into various critical areas, such as marketing, human resources, or product development. Additionally, short-term rentals for events and legal war rooms can meet temporary demand.

For instance, a business that leases a copier may only need to pay a fraction of the purchase price initially, thereby preserving cash flow for operational needs. Additionally, leasing often includes maintenance and service agreements, which can further mitigate unexpected expenses that might arise from equipment ownership.

Furthermore, considering factors such as depreciation, tax implications, and the total cost of ownership can significantly influence the decision-making process, often leading organizations to view leasing as an optimal solution. Companies can explore daily and weekly rentals for short-term equipment needs.

Predictable Monthly Payments

Leasing copiers provides businesses with the advantage of predictable monthly payments, which facilitates effective cash flow management and mitigates the unexpected financial burdens associated with equipment ownership.

This structured approach simplifies budgeting, allowing organizations to allocate funds more effectively each month. By clearly understanding anticipated costs, businesses can avoid surprises that may disrupt their financial plans. Leasing agreements often include additional benefits; for example, maintenance services are typically part of the package, ensuring that any necessary repairs or upkeep do not lead to unforeseen expenses.

Through leasing, companies can:

- Free up capital for other investments

- Upgrade equipment regularly without the responsibilities of ownership, ensuring access to the latest office technology

- Mitigate risks associated with depreciation

These advantages not only enhance operational efficiency but also contribute to long-term sustainability.

Access to Latest Technology

Leasing copiers offers businesses access to the latest technology, including high-capacity printers and advanced features such as duplex scanning, which may be prohibitively expensive through outright purchases.

This leasing option not only promotes innovation within the organization but also provides the flexibility to adapt to rapid technological advancements. It ensures that companies can seamlessly integrate modern equipment into their workflows without the substantial financial burden associated with purchasing.

By choosing to lease, businesses can:

- Remain competitive with up-to-date production printers that enhance productivity.

- Reduce operational costs, as leasing typically includes maintenance and support services.

- Take advantage of tax deductions, as lease payments can be classified as operating expenses. Utilize multicopy devices to handle document overflow efficiently.

The ability to access cutting-edge technology through leasing significantly enhances efficiency and effectiveness in various business operations. Organizations can prioritize technology upgrades to stay competitive.

Flexibility to Upgrade

The ability to upgrade equipment represents a significant advantage of leasing copiers, allowing businesses to adapt their office technology to meet evolving demands without the constraints associated with equipment ownership.

In today’s fast-paced business environment, remaining at the forefront of technological advancements is essential. Leasing provides a structured method for upgrading office technology, enabling organizations to transition to newer models with minimal disruption. Typically, during the lease term, businesses are afforded the opportunity to upgrade equipment at predetermined intervals, as specified in the initial lease agreement. Opt for easy rentals to simplify the process.

This arrangement facilitates organizations in the following ways:

- Evaluating their ongoing needs and the latest technological advancements.

- Minimizing disruptions by scheduling upgrades during off-peak periods.

- Leveraging new features that enhance productivity and efficiency.

Many leasing contracts include stipulations that outline the conditions and timing for upgrades, ensuring that businesses are equipped with the most effective tools available. Such provisions underscore the importance of technology upgrades as a critical component of operational success.

Tax Benefits

Leasing copiers can yield substantial tax benefits, as many lease payments may be fully tax-deductible, thus providing a financial advantage compared to purchasing equipment outright.

Along with the direct deductions from lease payments, businesses may experience enhanced cash flow and increased financial flexibility. By opting to lease rather than buy, companies can allocate their resources more efficiently, preserving capital for other operational needs or investments. This strategy is particularly advantageous for startups or small businesses that must adhere to a tight budget while maintaining productivity.

- Leasing copiers enables businesses to avoid significant upfront costs.

- It affords predictable monthly expenses, facilitating budgeting and financial planning.

- Many lease agreements include maintenance and support, thereby reducing additional expenses.

Furthermore, the ability to upgrade to newer technology every few years allows businesses to remain competitive in the market without the constraints associated with outdated equipment.

What Are The Drawbacks Of Leasing Copiers?

While leasing copiers offers numerous advantages, such as those provided by USA Copier Lease, it is essential to consider the potential drawbacks that may arise. These include a potentially higher overall cost in comparison to purchasing outright and the long-term commitment typically associated with most lease agreements.

Higher Overall Cost

One significant drawback of leasing copiers, even from renowned providers like We Rent Copiers, is the potential for a higher overall cost compared to purchasing equipment outright, which may strain budgetary considerations throughout the term of the lease.

In the long term, businesses should meticulously evaluate the financial implications, as leasing often incurs cumulative expenses that can far exceed the initial purchase price. While leasing may offer short-term cash flow flexibility, it is essential to recognize that the total expenditure over several years can substantially affect the overall investment strategy.

Financing options may seem appealing; however, it is crucial to acknowledge how the recurring payments accumulate, particularly when considering the following factors:

- Maintenance costs included in the lease versus separate costs associated with owned equipment.

- Depreciation benefits of outright purchases compared to the continuous payment cycle of leases.

- The opportunity cost of capital that could be allocated to other investments if significant lease payments dominate the financial landscape.

Ultimately, a thorough analysis of these factors can assist decision-makers in identifying the most cost-effective approach to acquiring office equipment, especially when considering copier rental options.

Long-term Commitment

Leasing copiers typically necessitates a long-term commitment, which may not be suitable for all businesses, particularly those that undergo rapid changes in their operational requirements.

This lack of flexibility can pose significant challenges, as organizations may find themselves bound by agreements, unlike flexible daily weekly rentals, that no longer align with their evolving needs. Small businesses, for example, may struggle to adapt to sudden technological advancements or shifts in market demands, rendering a long-term lease an inappropriate choice.

Key concerns associated with long-term leasing include:

- High termination fees

- Limited ability to upgrade equipment

- Strained financial resources due to extended commitments

Consequently, many companies perceive the long-term leasing model as disadvantageous, especially when the initial investments in copier leasing do not produce commensurate benefits over time. Therefore, it is essential for any organization considering long-term leasing arrangements to understand these challenges thoroughly.

Potential Penalties for Early Termination

One of the significant drawbacks of leasing copiers is the potential penalties associated with early termination, which can result in unforeseen costs and a negative experience with the rental company.

In many cases, these penalties are incurred when the lease is terminated prior to the fulfillment of the agreed-upon term. For businesses, this can lead to substantial financial repercussions that disrupt operational plans.

It is essential for enterprises to meticulously evaluate the conditions specified in their leasing agreements, particularly those pertaining to early termination clauses. These conditions can vary considerably among rental companies, with some imposing substantial fees that may not have been fully understood at the outset.

- Such costs could adversely affect cash flow.

- A negative leasing experience may discourage future engagement with the same rental company.

- A thorough understanding of these penalties can enable businesses to make informed decisions, potentially avoiding unexpected costs.

Therefore, conducting a comprehensive review of the lease terms will facilitate the alignment of the leasing strategy with the company’s financial objectives.

Limited Customization Options

Leasing copiers may present limited customization options, which can hinder a business’s ability to tailor office technology to its specific needs and preferences.

When considering the disadvantages of leasing, a significant concern is the inflexibility that often accompanies leased equipment. For many organizations, the optimal setup consists of systems that can be customized to enhance workflow efficiency, increase productivity, and align with unique operational strategies. Without the ability to modify features or capabilities, companies may struggle to meet their specific requirements.

- Businesses may observe decreased employee satisfaction if the tools provided do not adequately support their needs.

- Limited options can also result in increased operational costs, as teams may need to adapt to the limitations of equipment that does not align with their operational requirements.

Ultimately, it is essential for stakeholders to comprehend how restricted personalization can impact overall business performance when contemplating the leasing of office technology.

How To Choose The Right Lease Copier for Your Venues?

Selecting the appropriate leased copier necessitates a comprehensive evaluation of your specific needs, careful consideration of your budget, and a thorough understanding of the various leasing options available.

This approach ensures that the chosen equipment is aligned with your business objectives and operational requirements, providing significant leasing advantages.

Assess Your Needs

The initial step in selecting the appropriate lease copier involves a comprehensive assessment of your organization’s needs concerning office technology. This includes evaluating print volume requirements, the necessity for multifunctionality, and identifying specific features essential for your operations.

Conducting a thorough needs assessment is crucial for any organization seeking to optimize its printing capabilities, especially when considering office rentals.

Begin by evaluating the print volume, which pertains to the quantity of documents produced on a daily or monthly basis; this evaluation will help ascertain the necessary capacity.

Next, consider the following factors:

- Desired features

- Multifunctionality, including capabilities such as scanning, faxing, and emailing

- Network capabilities for shared environments

These considerations should align with the organization’s operational requirements. It is also important to assess the business environment, including any space constraints and the level of technical expertise available for maintenance. By taking these factors into account, one can ensure that the chosen copier will effectively meet the organization’s demands while enhancing productivity and efficiency.

Consider Your Budget

Considering the budget is essential when selecting the appropriate lease copier, as it determines the affordability of monthly or annual payments and the overall financial commitments involved.

In this context, evaluating budget considerations with providers like Impact Store entails examining several critical aspects that can significantly impact financial health. Understanding the initial costs associated with leasing, such as security deposits and installation fees, is vital. Additionally, it is important to forecast long-term expenses, including maintenance services and supplies, to ensure these align with the financial plans.

- Assess the duration of the lease agreement, as this can influence overall costs.

- Factor in the potential for technology upgrades, which may be included in leasing options.

- Analyze the benefits of rental contracts, which can provide flexibility without the responsibilities associated with ownership.

By incorporating these elements into financial planning, decision-makers can select a leasing option that not only addresses immediate needs but also supports sustainable growth over time.

Research Different Lease Options

Conducting thorough research on various lease options, such as those offered by Xerox, is imperative for identifying a rental company that provides terms and conditions aligned with your business requirements, including maintenance services and support.

In today’s competitive market, comprehending the distinctions between different leasing advantages is essential for making informed decisions. By comparing offerings from multiple rental companies, businesses can evaluate critical factors such as pricing, flexibility in lease terms, and available services. This method not only maximizes value but also facilitates a more efficient leasing experience.

- Assess Pricing Structures: Different companies may present varying rates based on the length of the lease and usage.

- Evaluate Support Services: It is advisable to seek companies that offer comprehensive maintenance and customer support.

- Consider Flexibility: Certain leases may provide options for upgrades or modifications that better suit your operational needs.

Ultimately, a comprehensive comparison enables businesses to make strategic leasing decisions that positively impact their growth and overall operational efficiency.

Read the Fine Print

Reading the fine print of leasing agreements is essential for understanding any obligations, conditions, and fees that may influence your experience with copier leasing.

In this process, it is important to pay careful attention to several key areas that often carry significant implications for both financial and operational commitments.

- Penalties: It is crucial to identify any fees associated with early termination or breaches of contract, as these could result in unexpected costs.

- Maintenance: One must understand what maintenance is covered under the agreement, including response times and procedures for addressing repairs.

- Service Levels: Evaluate the service guarantees provided by the leasing company, particularly concerning uptime and support.

By thoroughly reviewing these clauses, lessees can protect themselves against potential pitfalls and ensure clarity in their copier leasing experience.

Ask for Recommendations

Requesting recommendations from colleagues or industry peers can yield valuable insights regarding which rental companies provide reliable copier leasing services from USA Copier Lease and maintain a strong reputation.

When seeking information on copier leasing, engaging in discussions with trusted associates can significantly influence one’s decision-making process. These connections may share their past experiences, emphasizing both the advantages and potential challenges associated with various companies. Recommendations can often reveal options that may not have been previously considered.

- Networking can uncover exceptional opportunities, such as local firms that consistently exceed expectations.

- Feedback from peers may assist in identifying companies with outstanding customer support and maintenance services.

- Personal success stories can enhance confidence in selecting the appropriate service provider.

Ultimately, cultivating a professional network not only facilitates the acquisition of recommendations but also deepens the overall understanding of market offerings.

What Are The Steps To Leasing A Copier?

Leasing a copier entails several essential steps, beginning with selecting a copier that aligns with your business requirements. This process includes negotiating lease terms and coordinating the delivery and setup, thereby ensuring a seamless transition to utilizing the rental equipment.

Choose a Copier

Selecting a copier represents the initial step in the leasing process, requiring businesses to carefully assess their specific requirements for office technology, including print volume and essential features.

This important decision influences not only daily operations but also long-term efficiency and costs. As one embarks on the journey of leasing a copier, it is crucial to evaluate several key factors:

- Brand Reputation: Established brands typically offer reliable performance and superior customer support.

- Functionality: It is essential to consider which functions are necessary—color printing, scanning, or double-sided printing can greatly impact productivity.

- Compatibility: Ensure that the selected copier integrates seamlessly with existing systems and software, as this can save time and minimize operational disruptions.

By thoughtfully considering these factors, businesses can make well-informed decisions that align with their unique needs.

Negotiate Lease Terms

Negotiating lease terms is a critical step that can significantly impact the overall cost and conditions of a copier rental agreement with Impact Store, ensuring mutual benefit for both parties involved.

When entering into a copier rental agreement, it is imperative to thoroughly address the terms that will govern the partnership. For example, payment schedules should be customized to align with the financial capabilities of the renting party, providing flexibility while also maintaining the supplier’s cash flow.

Additionally, maintenance clauses are essential for delineating responsibilities related to upkeep and repairs, thereby minimizing the potential for conflicts. Including clearly defined penalties for missed payments or contract violations serves to protect both the leasing company and the renter, ensuring that expectations are established from the outset.

- Consider alternative payment schedules that accommodate both parties.

- Clarify maintenance responsibilities within the contract.

- Establish penalties to mitigate misunderstandings and disputes.

Sign the Lease Agreement

Signing the lease agreement formalizes the leasing process and signifies a commitment to the terms agreed upon for the copier rental.

Before finalizing any contract, it is essential for businesses to thoroughly examine various factors that could impact their operations and budget. This includes a clear understanding of maintenance responsibilities, as well as any potential penalties that may arise if specific conditions are not met.

Organizations should pay particular attention to the following aspects:

- Service Terms: It is important to clarify who will be responsible for repairs and regular maintenance of the copier.

- Penalty Clauses: Identifying any fees associated with early termination or exceeding usage limits is crucial.

- Warranty Coverage: Ensuring that the lease includes adequate warranty provisions can help mitigate unexpected repair costs.

By being well-informed about these components, businesses can protect their interests and facilitate a more seamless leasing experience.

Set Up Payment Schedule

Establishing a payment schedule that aligns with budget considerations is essential for effectively managing cash flow throughout the lease period.

To create an effective payment structure, it is critical to evaluate various factors, including monthly expenditures and potential additional costs that may arise during the lease term. One should begin by assessing all fixed and variable expenses associated with the lease, which may include:

- Initial deposit amounts

- Applicable maintenance fees

- Insurance costs

- Utility bills

Once these elements are clearly defined, the total amount can be divided into manageable monthly installments that align with the financial framework. Furthermore, incorporating a contingency for unexpected expenses can significantly enhance the likelihood of maintaining a stable budget throughout the lease.

Schedule Delivery and Installation

Scheduling the delivery and installation of equipment is the final step in the leasing process, ensuring that on-site assistance is provided to set up the copier for immediate use.

The meticulous coordination of delivery and installation not only ensures the timely setup of the equipment but also significantly enhances the overall efficiency of office operations, especially when using services from We Rent Copiers.

It is essential to understand that the installation process involves more than simply placing the machine in the desired location; it requires a comprehensive assessment of the workspace, connections to power and network sources, and the configuration of the copier to meet specific business requirements.

Proper installation includes:

- Connecting the copier to necessary networks

- Testing all functionalities

- Providing training sessions for employees on effective equipment usage

Additionally, ongoing support may be offered to assist with any technical issues that may arise after installation, facilitating a seamless integration into daily operations. This support further enhances productivity, allowing team members to concentrate on their core responsibilities without disruptions.

Companies That Lease Copiers

Leasing a copy machine can be a great way to save on upfront costs, and in most cases, it also means you get to forget about variable maintenance costs and sudden surprise expenses when repairs are needed. When you lease a copier instead of buying it outright, you get flexibility and worry-free operation with leasing, and that can be a tremendous asset.

Leasing copiers is a common business practice, and several major companies specialize in this service. Here are three prominent companies known for leasing copiers:

-

Xerox Corporation

- Xerox is a well-known name in the world of printing and photocopying. They offer a wide range of copiers suitable for different business needs, from basic monochrome to advanced multifunction color copiers. Xerox leases come with various options, including maintenance and support services.

-

Canon Inc.

- Canon is another leading provider of digital imaging and printing solutions. Their copier lease options cater to businesses of all sizes. Canon’s range includes high-quality color and monochrome copiers, multifunction printers, and more advanced devices with innovative features like cloud connectivity and enhanced security.

-

Ricoh Company, Ltd.

- Ricoh is recognized for its comprehensive range of copiers and multifunction printers. Their lease offerings are diverse, accommodating businesses seeking basic copiers to those needing sophisticated printing solutions with advanced features like mobile printing, energy efficiency, and robust document management capabilities.

Each of these companies not only provides a variety of copiers for lease but also offers flexible leasing terms and additional services like maintenance, technical support, and supplies management. Businesses can choose from these providers based on their specific requirements, budget, and preferred features.

COMPAREFrequently Asked Questions

What is a lease copier?

A lease copier, such as those provided by Xerox, is a rental agreement for a copier machine, where the user pays a monthly fee for a specified period of time to use the copier.

What are the benefits of leasing a copier?

Leasing a copier can be more cost-effective than purchasing one outright, as it allows for smaller monthly payments and avoids upfront costs. It also often includes maintenance and upgrades.

Can I customize my lease copier?

Yes, many lease copier agreements offer the option to add on features and accessories to meet the specific needs of your business.

What is the difference between a lease copier and a rental copier?

A lease copier is a long-term rental agreement, typically for a period of 1-3 years, while a rental copier is a short-term agreement for temporary use.

Are there any downsides to leasing a copier?

One potential downside is being locked into a contract for a set period of time, which may not be ideal for businesses with fluctuating needs. It may also end up being more expensive in the long run compared to purchasing a copier.

Can I buy the leased copier at the end of the agreement?

Yes, most lease copier agreements offer the option to purchase the copier at the end of the lease term for a predetermined amount.

Copier Leasing Companies Near Me

From copier leasing in Miami, all the way to Los Angeles, we help you find affordable copier leasing companies near you.